Syndio: The Home of Workplace Equity

“If you want to be a successful company in the 21st century, you have to measure workplace equity and you have to do it all the time,” says Syndio CEO Maria Colacurcio, who notes that this is the realization that has Fortune 1000 companies lining up to use her company’s real-time pay-equity analysis software, which offers a transformational alternative to traditional pay-equity analysis.

Syndio’s major differentiator, according to Colacurcio, is that its product helps companies do more than just treat the symptoms of problems—it shows how they’re interrelated and empowers them to solve their root causes.

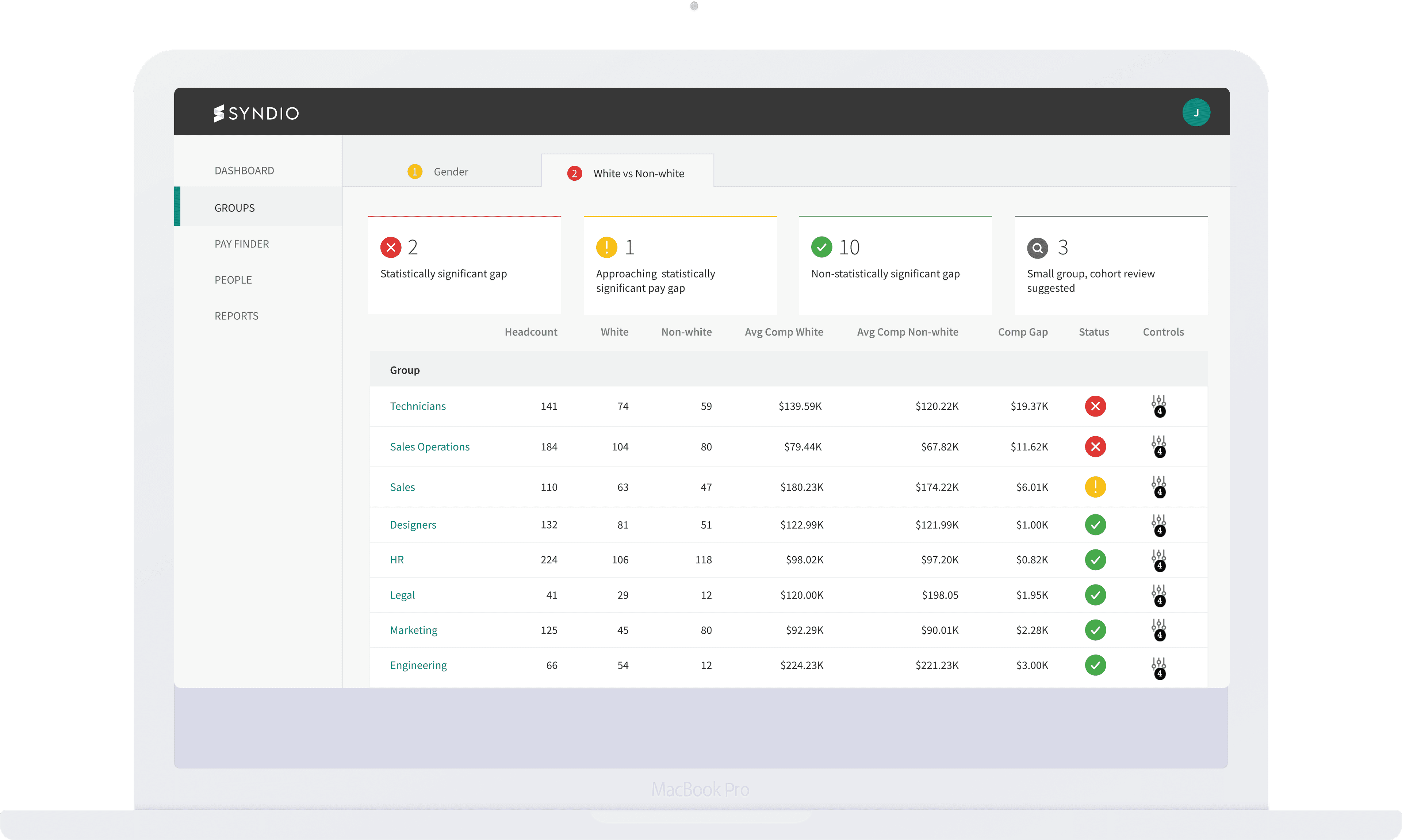

A traditional equal-pay analysis might end with a company being handed a report showing the cost of remediating unlawful disparities in pay. But over the months that it took to complete the report, the company might have continued with hiring, promoting, and bonusing cycles that further compounded disparities. Syndio is moving beyond simply ensuring legal compliance towards helping build equity and opportunity into each client’s culture.

By revealing gaps in internal movement and promotion in addition to unequal pay, Syndio’s software helps companies drastically reduce remediation budgets—while creating more diverse organizations from top to bottom.

“With our product, companies can show their boards that when they lift the hood on the car, they might find issues, but they’re going to be able to fix them—and this time, it’s going to be different. Their first remediation budget might be the same as last year’s and they will see where they have opportunity gaps, but they’re going to be able to whittle those down and make real progress on their goals to build more diverse, equitable, and dynamic organizations.”

Syndio and Emerson Collective are leading cultural change around workplace equity.

Working with Emerson Collective is a “win-win-win” for Syndio, Colacurcio says. “Emerson Collective’s Venture Investing team is an extension of the Syndio team. Fern Mandelbaum is a trusted partner, leading with her deep network and thought leadership. With her experience teaching at Stanford, she brings the knowledge of the domain alongside the VC and operational expertise.” Mandelbaum adds, “We are proud of our partnership with Syndio, as they embody the values of the Emerson Collective Venture Investing team. Syndio is led by a mission-driven, inclusive leader who, together with her team, is doing foundational work to address the root causes of systemic challenges facing so many companies.”

— Maria Colacurcio"COMPANIES HAVE AN OPPORTUNITY TO GAIN THE TRUST OF EMPLOYEES, BUT IT CAN’T BE PERFORMATIVE LIP SERVICE."

Future trends in workplace equity analysis:

According to one recent study, 6 out of 10 employees were basing decisions about whether to leave or stay at their companies on the gap between what their employers were saying about issues like race and equity and what they were actually doing. “Companies have an opportunity to gain the trust of employees, but it can’t be performative lip service,” Colacurcio says. “They actually have to take real action that’s measurable and calculable to prove that they care about these issues and are working to solve them.”

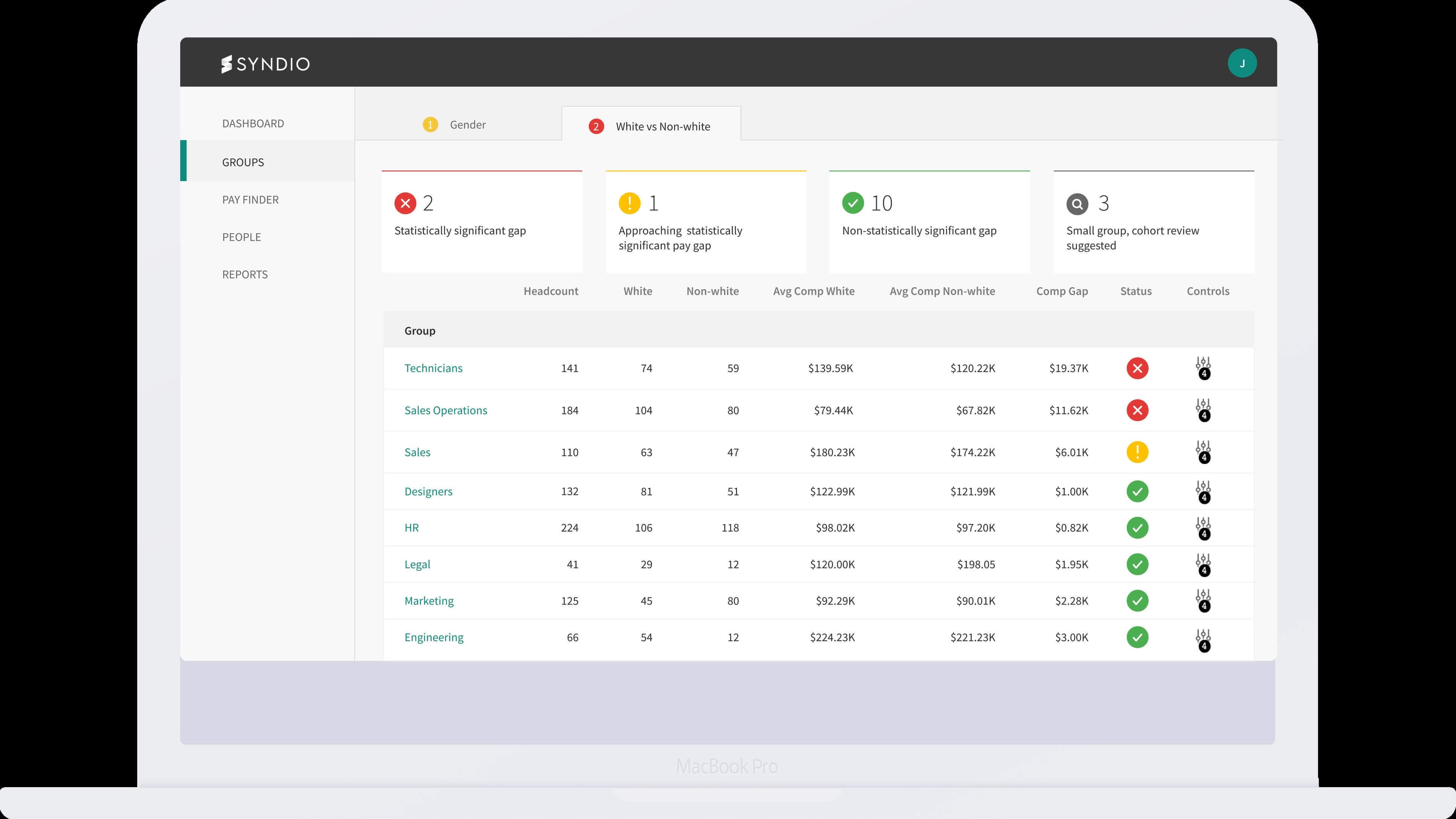

Syndio’s software was designed to measure gaps in terms of gender and race, plus their intersectionality, positioning the company to lead in a post-pandemic environment where the conversation has shifted from being mostly gender-focused to also taking racial equity into account. (Syndio 2021 Pay Equity Trends Report.)

Colacurcio predicts that as institutional investors continue to take a much bigger role in establishing standards around ESG investing, Human Capital metrics and disclosure, the SEC and Congress will follow with new requirements for transparency and reporting.